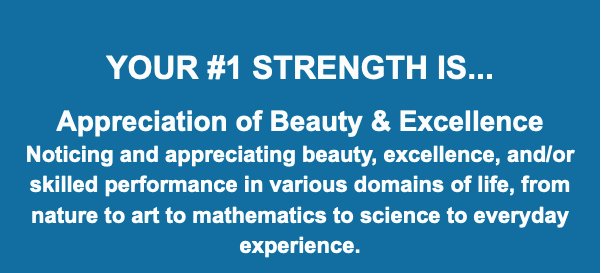

My back hurts… but I just love gardening. I am one to always stop and smell the lilacs, and crouch to take in as much of that sweet lily-of-the-valley scent as I can. I find it a little hard to make time for tending my own garden (is there a metaphor there?) but I really did on the May long weekend. I wouldn’t say I have a green thumb, though I am working on it. What I have is reverence for life and appreciation of beauty. That is actually my number one quality according to the VIA Institute on Character survey. (You can take yours here: www.viacharacter.or/survey/account/register)

I believe this makes me a great friend and a caring service provider. I want the people around me to thrive, and I’m grateful to have some skills that enable me to help.

Here are my latest Oprah-style favourite things that have me thriving lately…

My current meal obsession is still that breakfast hash from Q1. (Ask me to send you the recipe if you missed it.)

As well, I peeled myself a whole bunch of ginger and froze it for the following uses:

Morning drink of hot water, grated ginger, squeeze of lemon and a pinch of salt. I also sometimes add a dash of turmeric and.or cumin. Sip is while sitting in a squat and watch your digestive problems disappear.

Spiced rice. When I cook rice I’m in the habit of adding grated ginger, salt, olive oil, powdered cinnamon, cumin, turmeric and clove, and cardamom pods. This flavoured rice makes me so happy.

Best new habit is keeping a journal for the next day. Each night, before bed, I write down a basic schedule for my day, including scheduled meetings or workouts, and anything I’m committed to getting done, as well as notes and tasks to remember. It really helps with clearing my mind for a good sleep. I have a Whoop band, a biofeedback device, that reports a much better recovery when I do this practice and follow it with a bit of stretching before I go to sleep.

Best non-fiction – Big Magic by Liz Gilbert had me wishing it would never end. I listen to audiobooks and I loved having her speak to me, as an encouraging friend. I believe there are unlimited ways to express creativity so I think everyone could benefit from reading this book.

Most interesting fiction – I was listening to Good Omens by Terry Pratchett and Neil Gaiman and I liked it very much. But the show, starring David Tenant and Michael Sheen was more enjoyable for me. David Tenant is so fun to watch – wow. Every moment he was on screen I was captivated and wanted more. I think this is going to me a comfort re-watch show for me.

And here are some thoughts on mortgages and the market…

I think many people working in and selling real estate have felt a little frustrated by a lagging (or absent?) spring market. Prices remain down in many postal codes. There was an expectation for pent up demand to spark once the Bank of Canada began to lower interest rates (0.25% on June 5). There certainly were a lot of small celebrations about that, but I’m getting a bit of a “too little, too late” feeling for any real enthusiasm. Of course this pace is much more civilized for buyers, and that’s why the BoC is taking it slow. They are still concerned about prices. Urgency is low and that, honestly, would be the market I’d want to shop in. Still, many buyers seem to be waiting for rates to fall further… they could be waiting long enough to get priced out of the market. The saying “the best time to buy was 5 years ago… the second best time is now” remains true. 3 year fixed rates remain a popular rate, giving borrowers a stable rate for the period without committing to the long-popular 5 year fixed. Few people are starting to trust variable rates again.

Remember, the Bank of Canada rate announcements only directly affect VARIABLE rates. Fixed rates are still about 1% lower than variable (with the discounts). Most rate holds, and payment calculations are made on fixed rates, which are affected by bond yields, not PRIME RATE. So the BoC announcement would have little, if any, bearing on anyone’s pre-approval. Everything is connected, and therefore the expectation is for a downward trend in all rates. Economists are calling for additional rates drops and expect to be down another 1.75% by the end of 2025.

As always…

I want to hear from you, especially if you are thinking a change is coming, or one has come. I always recommend a having a discovery call and putting together a plan as well in advance as possible. There are so many decisions to make when it comes to buying/selling/moving/refinancing. It’s better to have a plan that can be adjusted to fit, than to have to make all your decisions under the gun.

https://calendly.com/kristendlc

If you’re interested, here’s a list of the books I’ve read in 2024 so far. If you’ve read any of the below I’d love to chat about them with you!

Tom Lake – Ann Patchett

Rest is Resistance – Tricia Hersey

House of Flame and Shadow – Sarah J Maas

The Iliad – Homer, translated by Emily Wilson

The Odyssey – Homer, translated by Emily Wilson

Pride and Prejudice – Jane Austen

Revolutionary Witchcraft – Sarah Lyons

A Grandmother Begins the Story – Michelle Porter

Good Omens – Terry Pratchett and Neil Gaiman

Miracle Morning – Hal Elrod

Great Courses Dante’s Divine Comedy – William R Cook and Ronald Herman

Covenant of Water – Abraham Verghese

Big Magic – Elizabeth Gilbert

Shantaram – Gregory David Roberts