|

|

|

General Kristen Vettraino 14 Aug

|

|

|

General Kristen Vettraino 3 Jul

If you are someone who is considering entering the housing market this summer, there are a few things you should keep in mind:

Determine Your Budget: Download my app from Google Play or the Apple iStore to help you calculate mortgage payments, affordability, the income required to qualify, and even estimate your closing costs! It also allows you to connect directly with me through the app so that I can answer any questions you have right in the palm of your hand.

Save For a Down Payment: Your typical down payment should be at least 5% of the purchase price, though 20% down is preferable as anything below that requires default insurance. Your down payment can be done through your own savings account or RRSP’s.

Take Advantage of First-Time Buyer Programs: Did you know? First-time home buyers are eligible for an exemption, reducing the amount of property transfer tax paid, depending on the property’s value.

Understand the Closing Costs: Closing costs are a one-time fee associated with the sale of a home and are separate from the mortgage insurance and down payment. Typically, these costs range from 1.5-4% of the purchase price, depending on your location. Factoring these costs into your maximum budget can help you narrow down an entirely affordable home and ensure future financial stability and security.

Here are a few closing costs to keep an eye out for:

Getting Proper Coverage: Purchasing a home is likely the largest investment you will make, and you want to ensure it is protected.

Various insurance items can be obtained for your home, including:

Whether you’re looking at a condo, townhouse, rancher, or a two-story property, there is nothing quite like your first home! However, the mortgage process can be intimidating – and that’s where I come in! If you’re looking to get started on your home-buying journey, don’t hesitate to reach out to me today.

General Kristen Vettraino 25 Jun

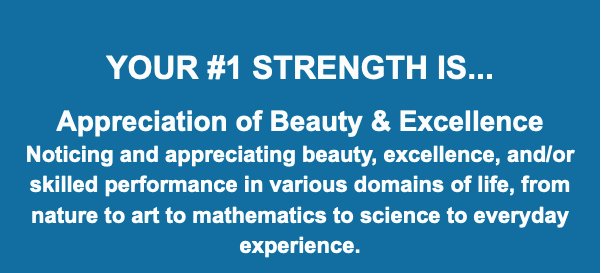

My back hurts… but I just love gardening. I am one to always stop and smell the lilacs, and crouch to take in as much of that sweet lily-of-the-valley scent as I can. I find it a little hard to make time for tending my own garden (is there a metaphor there?) but I really did on the May long weekend. I wouldn’t say I have a green thumb, though I am working on it. What I have is reverence for life and appreciation of beauty. That is actually my number one quality according to the VIA Institute on Character survey. (You can take yours here: www.viacharacter.or/survey/account/register)

I believe this makes me a great friend and a caring service provider. I want the people around me to thrive, and I’m grateful to have some skills that enable me to help.

Here are my latest Oprah-style favourite things that have me thriving lately…

My current meal obsession is still that breakfast hash from Q1. (Ask me to send you the recipe if you missed it.)

As well, I peeled myself a whole bunch of ginger and froze it for the following uses:

Morning drink of hot water, grated ginger, squeeze of lemon and a pinch of salt. I also sometimes add a dash of turmeric and.or cumin. Sip is while sitting in a squat and watch your digestive problems disappear.

Spiced rice. When I cook rice I’m in the habit of adding grated ginger, salt, olive oil, powdered cinnamon, cumin, turmeric and clove, and cardamom pods. This flavoured rice makes me so happy.

Best new habit is keeping a journal for the next day. Each night, before bed, I write down a basic schedule for my day, including scheduled meetings or workouts, and anything I’m committed to getting done, as well as notes and tasks to remember. It really helps with clearing my mind for a good sleep. I have a Whoop band, a biofeedback device, that reports a much better recovery when I do this practice and follow it with a bit of stretching before I go to sleep.

Best non-fiction – Big Magic by Liz Gilbert had me wishing it would never end. I listen to audiobooks and I loved having her speak to me, as an encouraging friend. I believe there are unlimited ways to express creativity so I think everyone could benefit from reading this book.

Most interesting fiction – I was listening to Good Omens by Terry Pratchett and Neil Gaiman and I liked it very much. But the show, starring David Tenant and Michael Sheen was more enjoyable for me. David Tenant is so fun to watch – wow. Every moment he was on screen I was captivated and wanted more. I think this is going to me a comfort re-watch show for me.

And here are some thoughts on mortgages and the market…

I think many people working in and selling real estate have felt a little frustrated by a lagging (or absent?) spring market. Prices remain down in many postal codes. There was an expectation for pent up demand to spark once the Bank of Canada began to lower interest rates (0.25% on June 5). There certainly were a lot of small celebrations about that, but I’m getting a bit of a “too little, too late” feeling for any real enthusiasm. Of course this pace is much more civilized for buyers, and that’s why the BoC is taking it slow. They are still concerned about prices. Urgency is low and that, honestly, would be the market I’d want to shop in. Still, many buyers seem to be waiting for rates to fall further… they could be waiting long enough to get priced out of the market. The saying “the best time to buy was 5 years ago… the second best time is now” remains true. 3 year fixed rates remain a popular rate, giving borrowers a stable rate for the period without committing to the long-popular 5 year fixed. Few people are starting to trust variable rates again.

Remember, the Bank of Canada rate announcements only directly affect VARIABLE rates. Fixed rates are still about 1% lower than variable (with the discounts). Most rate holds, and payment calculations are made on fixed rates, which are affected by bond yields, not PRIME RATE. So the BoC announcement would have little, if any, bearing on anyone’s pre-approval. Everything is connected, and therefore the expectation is for a downward trend in all rates. Economists are calling for additional rates drops and expect to be down another 1.75% by the end of 2025.

As always…

I want to hear from you, especially if you are thinking a change is coming, or one has come. I always recommend a having a discovery call and putting together a plan as well in advance as possible. There are so many decisions to make when it comes to buying/selling/moving/refinancing. It’s better to have a plan that can be adjusted to fit, than to have to make all your decisions under the gun.

https://calendly.com/kristendlc

If you’re interested, here’s a list of the books I’ve read in 2024 so far. If you’ve read any of the below I’d love to chat about them with you!

Tom Lake – Ann Patchett

Rest is Resistance – Tricia Hersey

House of Flame and Shadow – Sarah J Maas

The Iliad – Homer, translated by Emily Wilson

The Odyssey – Homer, translated by Emily Wilson

Pride and Prejudice – Jane Austen

Revolutionary Witchcraft – Sarah Lyons

A Grandmother Begins the Story – Michelle Porter

Good Omens – Terry Pratchett and Neil Gaiman

Miracle Morning – Hal Elrod

Great Courses Dante’s Divine Comedy – William R Cook and Ronald Herman

Covenant of Water – Abraham Verghese

Big Magic – Elizabeth Gilbert

Shantaram – Gregory David Roberts

General Kristen Vettraino 25 Jun

From Sherry Cooper…

Inflation unexpectedly rose in May, disappointing the Bank of Canada as it deliberates the possibility of another rate cut next month.

The Consumer Price Index (CPI) rose 2.9% in May from a year ago, up from a 2.7% reading in April. This increase primarily reflects higher prices for services and, to a lesser extent, food. According to a Bloomberg survey, economists had expected 2.6% inflation last month.

Cellular services, travel tours, rent, and air transportation boosted service prices by 4.6% year-over-year (y/y) in May, up sharply from the 4.2% rise in April. Price growth for goods remained at 1%, although grocery prices rose more rapidly.

Monthly, the CPI index climbed 0.6% compared to expectations for a 0.3% gain and up from 0.5% in April. On a seasonally adjusted basis, inflation rose 0.3%.

The Bank of Canada’s preferred measures of core inflation, the trim and median core rates, exclude the more volatile price movements to assess the level of underlying inflation. The CPI trim accelerated to 2.9% in May, following a downwardly revised 2.8% rise the previous month. The CPI median rose two ticks to 2.8%. Both measures of core inflation surprised economists on the high side.

Shelter costs have been a massive component of inflation this cycle. In May, rent rose a whopping 0.9%, lifting the yearly rise to 8.9% y/y, the second largest contributor to annual inflation. The single most significant inflation driver–mortgage interest costs–ticked down a bit to 0.8% m/m, reducing the yearly pace to 23.3%. It peaked above 30% last year. Excluding shelter, inflation is rising 1.5% y/y, up from 1.2% last month.

Bottom Line

Today’s inflation reading was undoubtedly a disappointment for the Bank of Canada, and it reduces the chances of another rate cut when they meet again on July 24. However, the June inflation data will be released on July 16. Barring a significant drop in June inflation, the next interest rate cut will likely be at the September meeting. That’s not good for the housing market, which has slowed to a crawl in recent months. The decline in mortgage rates proceeds as market forces drive down bond yields. Canada’s labour market is slowing as the jobless rate ticks up. Tiff Macklem said yesterday that he did not expect the unemployment rate to rise significantly further this cycle.

Interest rate cuts will be more gradual because rapid population growth has boosted economic activity, forestalling a recession and adding to inflationary pressure. The central bank’s overnight policy rate, now at 4.75%, will gradually move to 3.0% by the end of next year.

General Kristen Vettraino 6 Jun

|

||||

|

General Kristen Vettraino 14 May

Before banks or lending institutions can consider loaning money for a property, they need to know the current market value of that property.

The job of an appraiser is to check the general condition of your home and determine a comparable market value based on other homes in your area. This is required for any buy or sell situation.

To help make the appraisal as smooth as possible and ensure you are getting top market value, check out the tips below:

Clean Up: The appraiser is basing the value of your property on how good it looks. A good rule of thumb is to treat the appraisal like an open house! Stage it as you would a home for sale, clean and declutter every room, vacuum, and scrub – even consider adding a fresh coat of paint – to ensure your home is as presentable and appealing as possible. Where applicable remove personal stigma items such as alcohol or drug paraphernalia, any controversial pictures or flags, etc.

Curb Appeal: First impressions can have a huge impact when it comes to an appraisal. Spending some time ensuring the outside of your property from your driveway entrance to front step is clean and welcoming can make a world of difference. Cut grass, water plants, maybe add flowers or hanging baskets to make things feel inviting and stage the yard with some lawn furniture to make it look like its own space.

Visibility: The appraiser must be able to see every room of the home, no exceptions. YES, ever singly room including outbuildings, garage, closets, basement… Refusal to allow an appraiser to see any room can cause issues and potentially kill your deal. If there are any issues with any spaces of your home, be sure to take care of them in advance to allow the appraiser full access. NOTE: If there are tenants in your home, ensure you give them appropriate amount of notice for access. YES, every single room, outbuilding, closet, garage needs access. Otherwise, the appraiser will have to return at added expense to you.

Upgrades and Features: Ensuring the appraiser is aware of any upgrades and features can go a long way. Make a list and include everything from plumbing and electrical to new floors, new appliances, etc. This way they have a reference as to what has been updated and how recent or professional that work was done. Knowing the age of the roof and HVAC items like water tank is important. Also, ensure the breaker box is MIN 100amps as most lenders cannot finance a home with amps under 100; older homes from the 1930 area are generally only 60amps. The same goes for knob and tube versus breaker set-ups. Upgrading is important and will add value.

Be Prudent About Upgrades: While the bathroom and kitchen are popular areas, they are not necessarily the be-all-end-all for getting a higher home value. These renovations can be quite costly so it is a good idea to be prudent about how you spend your money and instead, focus on easy changes such as new paint, new light fixtures or plumbing and updated flooring to avoid breaking the bank while still having your home look fresh. Removing clutter, adding a new coat of paint and doing a deep clean will help make these spaces shine.

Know Your Neighbourhood: You already know where you live better than the appraiser. Taking a look at similar homes in your neighbourhood and noting what they sold for will give you a ballpark. If your appraisal comes in low, you will be prepared to discuss with the appraiser the examples from your area and why you believe you property is worth more. In addition, keep in mind that appraisal values are based on recent sales data; if there have been zero sales in the area recently and time allows it, hold off on getting an appraisal done until some sales have been evident to ensure you’re getting the most value.

Be Polite: The appraiser is there to get in and get out so let them have the run of the house while they are there. Do not follow them around and avoid asking them too many questions or making too many comments and simply be prepared should they have questions. Once they have completed the review of your home, that is a good time to bring up any comments you might have. Remember, the actual onsite inspection usually is only 15 minutes through the house but typically, the bulk of work for appraisals is at the desk, reviewing sales and other forms of research to create the appraisal report.

Know The Costs: Every appraiser charges differently. If the lender allows for ordering appraisals direct, then I can shop around and fetch you the best price.

Don’t forget to contact me if you have any questions about your existing home or mortgage, or if you are looking to sell and relocate in the future!

General Kristen Vettraino 14 May

Not all insurance products are created equal. It is important to understand all the different insurance products to ensure you have proper coverage.

Below are the main insurance product options you will encounter with homeownership, and what they mean:

Default Insurance: This insurance is mandatory for homes where the buyer puts less than 20% down. In fact, default insurance is the reason that lenders accept lower down payments, such as 5% minimum, and actually helps these buyers access comparable interest rates typically offered with larger down payments. This insurance typically requires a premium, which is based on the loan-to-value ratio (mortgage loan amount divided by the purchase price). This premium can be paid in a single lump sum, or it can be added to your mortgage and included in your monthly payments.

Home (Property & Fire) Insurance: Next, we have another mandatory insurance option, property and fire coverage (or, home insurance, as most people know it by). This MUST be in place before you close the mortgage! It is especially important to note that not all homes or properties are insurable, so you will want to review this sooner rather than later. Keep in mind, with this coverage you may not have protection in the event of a flood or earthquake. You may need to purchase additional coverage to be protected from a natural disaster, depending on your location.

Title Insurance: When it comes to lenders, this insurance is mandatory with every single lender in Canada requiring you to purchase title insurance on their behalf. In addition, you have the option of purchasing this for yourself as a homeowner. The benefit of title insurance is that it can protect you from existing liens on the property’s title, but the most common benefit is protection against title fraud. Title fraud typically involves someone using stolen personal information, or forged documents to transfer your home’s title to him or herself – without your knowledge. Similar to default insurance, title insurance is charged as a one-time fee or a premium with the cost based on the value of your property.

Strata (Condo) Insurance: When it comes to a stratum, their insurance covers the building itself – meaning in the event of an incident (fire, flood, etc.) the building can be re-established. This however only covers common areas; it does not cover the contents of YOUR particular unit, which requires a homeowner’s insurance policy. Personal insurance can also help with the strata deductible. For example, in the event of a flood that originates from a unit, it will require fixes to the unit itself (under your personal policy) plus the building (covered by the strata policy). Depending on the type of claim or damage, owners are often relocated to a hotel while the unit is being repaired and the personal insurance would also cover being displaced.

To ensure that you remain up-to-date with your strata insurance policies, it is vital that homeowners living within a stratum to check with management for a copy of the most recent insurance policy. Always take your strata and individual policy to an insurance agent to ensure you are aware of your coverage and that your individual homeowner’s policy is working in your favor. Investment property owners especially need to check their existing deductible against the updated deductible and insurance policies to avoid any future issues.

Mortgage Protection Plan: This coverage is optional, but any mortgage professional will tell you is extremely important. The purpose of the mortgage protection plan is to protect you, and your family, should something happen. It acts as a disability and a life insurance policy in regards to your mortgage. Typically, when you get approval for a mortgage, it is based on family income. If one of the partners in the mortgage is no longer able to contribute due to disability or death, a mortgage protection plan gives you protection for your mortgage payments.

If you have any questions about mortgage insurance or what are the best options for you, please do not hesitate to reach out to me! I would be happy to take a look at your existing plan and discuss your needs to help you find the perfect coverage to suit you and your family.

General Kristen Vettraino 27 Sep

With Fall just around the corner, here are some of my favourite (and helpful!) home prep tips to help you be ready for the upcoming season.

Following these tips will ensure everything continues running well into the colder months!

Inspect Your Gutters: This time of year it is important to clean and inspect your gutters (replacing as needed) to ensure they are working properly as the rain and snow season hits. If they are clogged or damaged, it could result in a flooded interior and damaged exterior so don’t wait!

Check for Drafts: In the Fall and Winter, many homeowners are spending extra money heating their homes due to drafts, but it doesn’t have to be that way! Do a check on all exterior doors and windows to confirm if they are properly sealed. To do this, simply close a door or window on a strip of paper. If the paper slides easily, you need to update your weatherstripping.

Have Your Furnace Inspected: In Canada we are no strangers to chilly evenings! To ensure you are comfortable throughout the colder months, be sure to have your furnace inspected by an HVAC professional. They can check leaks, test efficiency, and change the filter. They can also conduct a carbon monoxide check to ensure air safety.

Don’t forget to change your filters quarterly, or even monthly if you have allergies.

Fix Any Concrete/Asphalt Cracks: This one is easy to ignore thinking it will be fine, but it could easily turn into a bigger issue. When water gets into existing cracks during the colder months it will freeze and expand, causing the crack to become even larger.

Turn Off Outdoor Plumbing: Since your garden will not need attention until the Spring, it is a good idea to shut off and drain all outdoor faucets and sprinkler systems. Depending on where you live, you might also want to cover them to prevent freezing during the Winter months.

Change Your Batteries: It is a good idea annually to check that all smoke detectors and carbon monoxide devices are working. While you’re doing your Fall and Winter home preparations, this is a good time to test your existing gadgets.

Latest News Kristen Vettraino 27 Sep

As we move into the Fall market, there are some important things you should be aware of.

While inflation has now likely peaked, we will still be dealing with the repercussions from these heightened levels for a while before things balance out. As inflation is corrected, we are also seeing home prices moving back to normal post-pandemic era.

However, we are still anticipating some final rate hikes from the Bank of Canada coming into the fall.

With that in mind, now is an important time to discuss what this means for your mortgage – specifically in regards to trigger points. Another increase in rates on the horizon will put many variable-rate borrowers near their mortgage trigger points – even for fixed payments.

While static payment variable-rate mortgages are not designed to fluctuate with prime, the reality is that a mortgage payment consistent of two components: your principle and your interest. With the existing rates and subsequent increases expected in the fall, the amount paid towards principle has decreased with an increase in the amount of interest on a static mortgage. For instance, if you are paying $2000 a month on your mortgage, only $200 might be going towards the principle with the rest covering interest. An additional increase to the interest rate, means that your interest portion will spike again and may actually exceed your total payment. When this occurs, it is called hitting your trigger rate.

You can calculate your own trigger rate with the following formula: (Payment amount X number of payments per year / balance owing) X 100) to get your trigger rate in percentage.

If you have reached your trigger rate, don’t panic. You are certainly not alone and there are options:

Adjust Your Payment: Firstly, you may choose to adjust your payment amount to ensure that you still have some going towards your principal balance.

Review Your Amortization Schedule: Consider switching your amortization schedule from 20-year to 25-year which would be ideal if you already have equity in your home. However, if you’re already at your maximum amortization for your lender (i.e. 30-year mortgage), you would need to increase your payment.

Switch to a Fixed-Rate Mortgage: Many borrowers are now choosing to opt for a fixed-rate mortgage to avoid the issue of increased interest and trigger rates. Keep in mind, depending on your mortgage product, you may face penalties if you switch your mortgage mid-term. Be sure to discuss any mortgage changes with me before going ahead.

Pay Off Your Mortgage: The final option that is always there is for you to pay off your mortgage entirely. Though don’t fret if this is not possible!

While I understand words like “inflation” and “trigger rates” can be scary, as your dedicated mortgage professional I am here for you. I would be happy to discuss any concerns you have or help explain in more detail how these changes may impact your mortgage and what your options are.

General Kristen Vettraino 1 May

As a casual fan of semantics and etymology and I wanted to share a little background for the word and use of “Mortgage”.

Friends. So. Few. Are. I watch Downton Abby on a repeating cycle so I understand that property was a huge deal back in the day. I mean, it still is but we take it so much for granted now.

Classic Middle Age English Lawyers… so dark.

Dream. Build your empire. Good day to you all.